Expand Your Insurance Horizons

BAIS offers differentiated benefits and business insurance solutions.

We are flexible and adaptable—and know that one size never fits all when it comes to insurance.

We are here to partner with you—to listen, learn, and custom build solutions that meet your current needs and that flex with your business’s future growth.

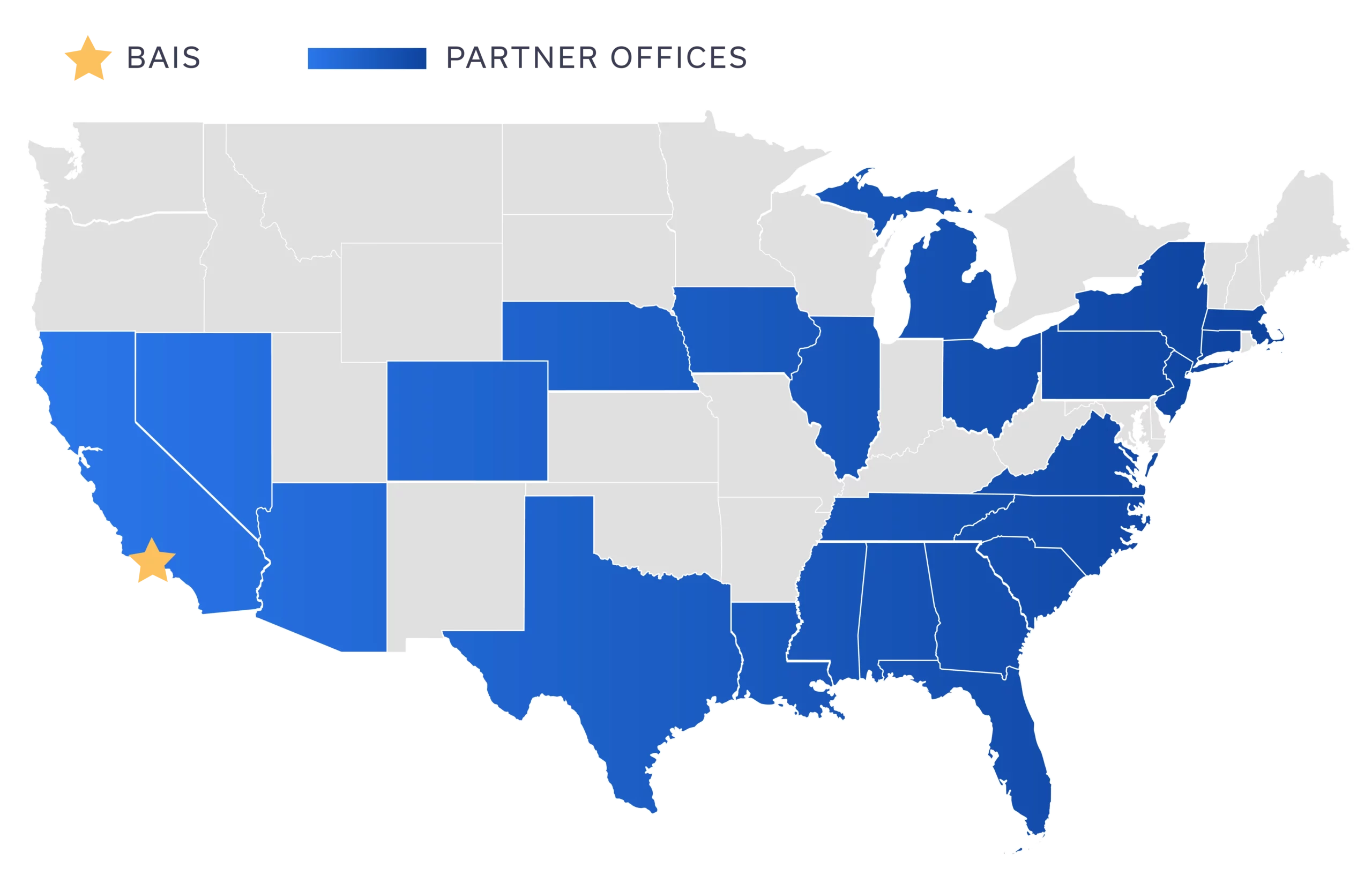

Strategic Partners

0

Partner Agencies

0

Offices Coast to Coast

0

Professionals

HR Services & Resources

Our advisors work with you to optimize your Human Resources department to keep up with your growing business.

Learn More About How We Can HelpTestimonials

We wholeheartedly recommend Benefits Alliance Insurance Services to any employer who is looking for a full-service employee benefits firm. Their clients (and many of ours) are grateful for their competence, expertise, ethics, honesty and ability to find solutions to difficult business problems as well as insurance issues. Our clients consider them one of their most valuable business partners.

Karen L. Martin, SPHR, SHRM-SCP